Sage RTI Training

Enquire About This CourseSage RTI Training Courses in Belfast NI

Real Time Information, or RTI, is one of the biggest changes to payroll legislation since 1944.

You will need to send data about PAYE, NIC and student loans to HM Revenue & Customs every time you pay your employees. It is imperative that your business and payroll software are ready for these important changes.

Are You RTI Ready?

Mullan Training are now offering Sage RTI courses in Belfast and throughout Northern Ireland to make sure you are!

What Will You Learn?

- Learn about the different online submissions required.

- How to ensure your payroll data is RTI compliant.

- Go ?€?hands on?€™ and practise the RTI routines in a demo environment.

Course objectives

By the end of this workshop you will:

- Understand why RTI is being introduced and how it affects your payroll processing

- Know how to prepare your data so that it is RTI ready

- Learn about the different RTI submissions including how & when to make them

- Identify & correct mistakes that may occur when processing under RTI

- See the impact RTI has on your payroll year end

Course Content

Preparing your software and data for RTI

- Ensure you are using the correct version of Sage 50 Payroll

- Prepare for submitting online

- Ensure you have the latest product updates installed

- Check your access rights

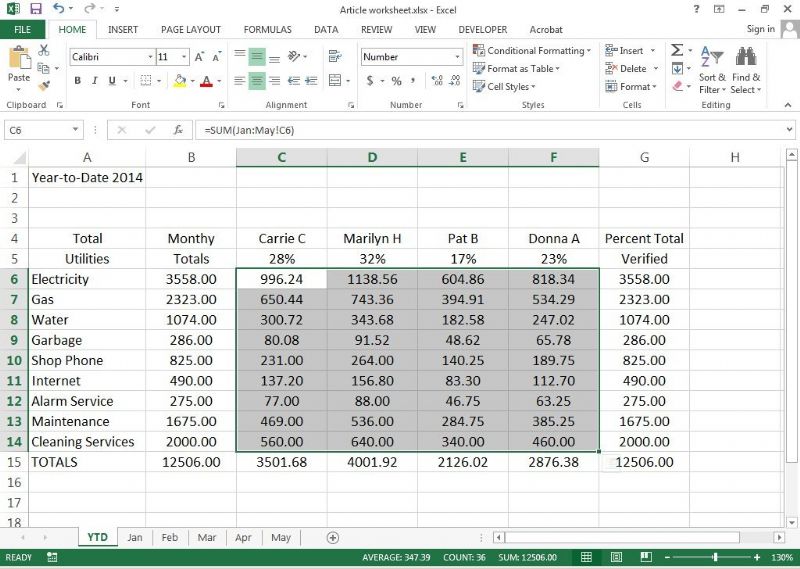

- Preparing your data for RTI

- Company data

- Employee personal data

- Employee payment data

- BACS hash and payment methods

- Final checks

- Employer Alignment Submission

Processing your payroll under RTI

- Starters and Leavers

- Casual workers

- Student employees

- Setting the process date

- Updating records

- Full Payment Submission

- Making the submission

Period End with RTI

- Period End

- P32 Report

- Employer Payment Submission

- When to submit

- Making the submission

Corrections and adjustments

- Correcting a Full Payment Submission

- Correcting payroll values

- Correcting personal employee information

- Correcting the Employer Payment Summary

- National Insurance Number Verification

- Making the submission and receiving confirmed National Insurance Number information

Payroll year end with RTI

- What?€™s no longer required?

- What remains the same?

Enquire About This Course