Rolling Forecasts with Excel 2013/2016/365

Enquire About This CourseWe are currently delivering Online Rolling Forecasts with Excel training via our Virtual Classroom - see our websites for more info:

https://www.mullanvirtualtraining.co.uk

https://powerbi-trainingbelfast.co.uk

PREREQUISITES

This course is not suitable for inexperienced Excel users. Delegates will be expected to be familiar with the following in Excel:

- Linking Spreadsheets

- IF Function & Nested IF Statements

- And & Or Functions

- Lookup Functions (Horizontal And Vertical Lookup)

- Subtotals

- Conditional Formatting

SUMMARY

The Rolling Forecast allows finance professionals to identify opportunities and risks that contribute to or imperil success.

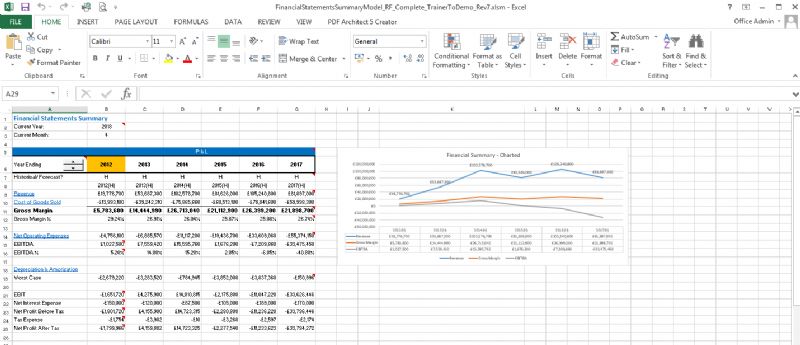

- This course will demonstrate how to build a cash flow model from scratch complete with assumptions, financials, supporting schedules and charts.

- Learn how to adjust model variables and source data sets using dashboard interfaces (radio buttons, drop down lists, command buttons etc.)

- You will also learn how to calculate forecast errors to update your financial model with more accurate.

- The second part of the day regarding cash flow forecasting will provide a similar tool for short- term tactical cash flow forecasting purposes.

LEARNING OUTCOMES

- On completion of this course you will have the ability to use some or all of the techniques and concepts presented for forecast generation within your own company

- Communicate business and data insights with visually compelling dashboards and models

COURSE CONTENT

- Design of fully integrated model (self balancing etc.)

- High level of automation of model based on a case study approach.

- Macro usage for basic assumption setting (e.g. dates covered), automation and report generation.

- Hierarchical bottomup reporting structure from monthly detailed to quarterly top level reporting.

- Reconciliation between the rolling aspect of the model with the requirement to recognise the financial implications

- Loading historical data (opening trial balance) automatically and accurately

- Model accuracy verification technique.

- Formulae to distinguish history from forecast

- Graphical outputs and key reports including use of conditional formatting and other techniques in KPI's etc.

- Sensitivity Analysis within the model as an inherent part of same.

- The second and much shorter part of the day will entail the creation of a 13 week rolling cash flow forecast. This will not be an integrated model but operate as standalone cash flow forecast at the tactical level i.e. at the creditor, debtor, sales order, individual payment etc.

Click here to download our Course Outline:

Rolling Forecasts with Excel(1)